The Evolution of Mobile Payments and Authentication Systems

Besides ensuring compliance with Strong Customer Authentication (SCA) regulations under PSD2, the new 3DS 2.0 protocol offers a range of benefits, particularly enhancing mobile payments. Its enhanced design significantly improves user experience on mobile devices, seamlessly integrating with mobile wallet apps and facilitating in-app transactions.

Early Challenges with 3D Secure 1.0

Mobile payments were not a focus in the early authentication systems. 3D Secure 1.0, the predecessor of 3D Secure 2.0, faced several challenges:

- User Experience Issues: Users frequently encountered difficulties with viewing the 3D Secure authentication page on their devices.

- Compatibility Problems: Mobile browsers often struggled with the authentication process.

- Slow Performance: Authorization pages loaded slowly, leading to frustration and potential security risks.

- User Perception: The additional authentication step was perceived as unnecessary, leading to transaction abandonment.

- Popup Window Concerns: Users were unable to verify the authenticity of popup windows, contributing to suspicion and transaction abandonment.

Advancements with 3D Secure 2.0

The new 3D Secure 2.0 protocol addresses these issues and offers several benefits, especially for mobile payments:

- Enhanced User Experience: 3D Secure 2.0 is designed to improve the user experience on mobile devices. It integrates seamlessly with mobile wallet apps and supports in-app transactions.

- Seamless Mobile Integration: Merchants can now integrate 3D Secure directly into their mobile apps using an SDK component. This integration ensures a consistent look and feel and enhances the checkout experience.

- Risk-Based Authentication: Authentication is prompted only when a transaction is deemed high-risk, reducing unnecessary friction.

- Biometric Authentication: The integration of biometric authentication within the app provides a robust security measure while keeping the authentication process transparent to cardholders.

DID YOU KNOW THAT...

70% of American users say security is their biggest worry when making mobile payments while

Key Features of 3D Secure 2.0

Frictionless Flow

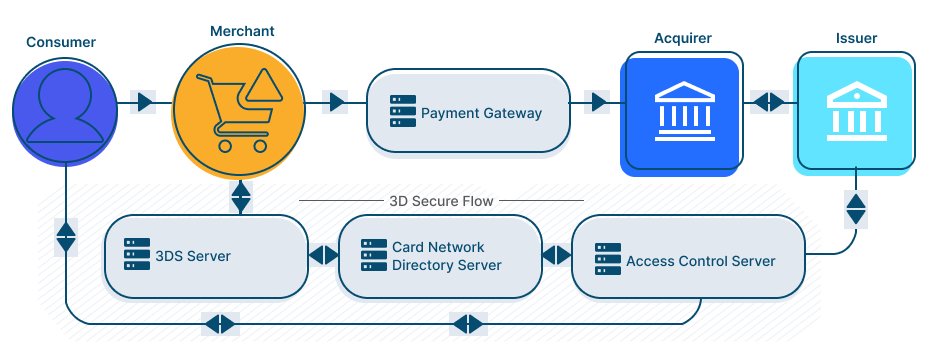

3D Secure 2.0 introduces frictionless flow, where the Access Control Server (ACS) handles risk-based authentication. Issuers can autonomously approve transactions, eliminating the need for cardholder input and streamlining the checkout process.

Non-Payment Authentication

The protocol extends beyond online transactions with “Non-payment authentication,” allowing cardholders to authenticate without making a purchase. This feature simplifies adding credit cards to e-wallets and removes the need for a $1 validation charge.

Native Mobile Integration

With the inclusion of a mobile SDK component, 3D Secure 2.0 enables merchants to integrate authentication processes directly into mobile apps, ensuring a swift and smooth checkout experience for mobile users.